Category: Finance

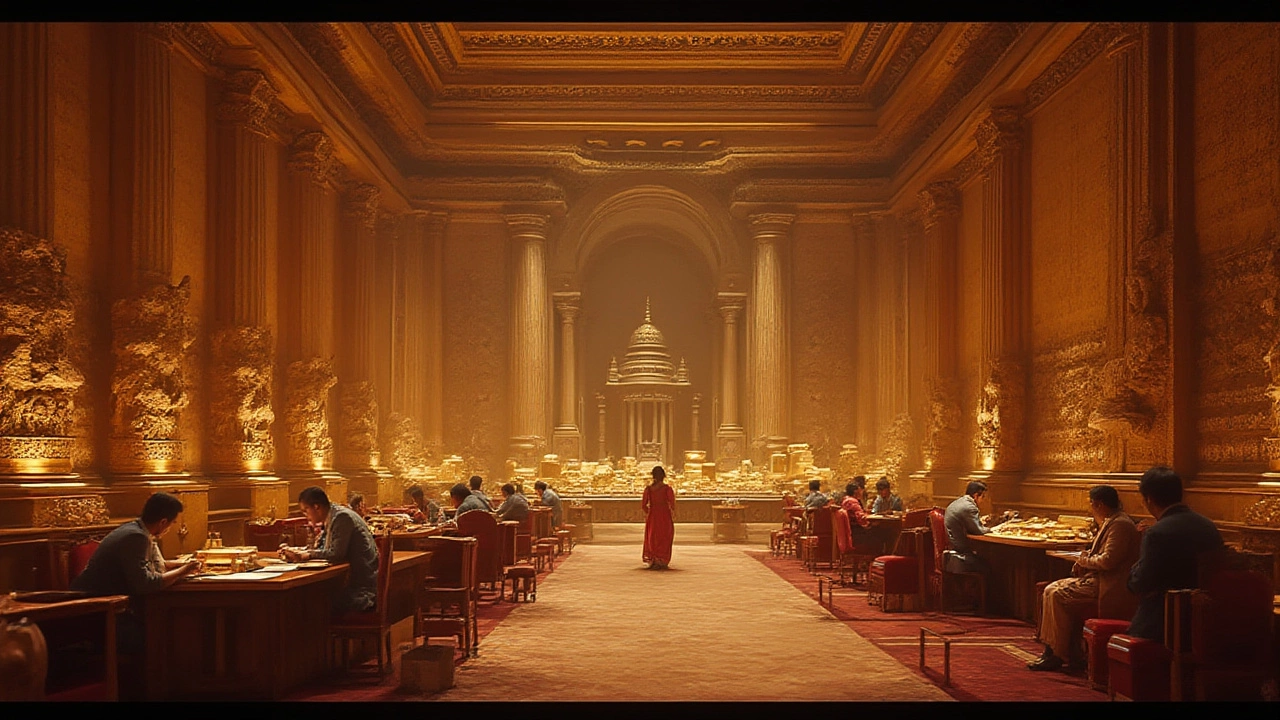

Who Owns the Most Gold in the World? Surprising Facts & Hidden Hoards

Discover who truly owns the most gold worldwide. Explore central banks, secret stashes, private collectors, and how gold shapes global power.

Safest Ways to Get a Personal Loan in India: Expert Tips and Secure Options

Confused about where to get a safe personal loan in India? Discover top trusted places, key tips, and real facts to protect your money and credit health.

HDFC vs SBI: Which Bank is Safest for Your Money in 2025?

Can you trust your money with HDFC or SBI? This breakdown covers bank stability, government backing, financial health, and what really keeps your savings safe.

Top Private Banks for Business Loans in India

Finding the leading private bank in India for business loans can be crucial for entrepreneurs and business owners. This article explores key players in the banking sector, analyzing their offerings in business loans. With a spotlight on factors like interest rates, loan terms, and customer service, readers will understand what sets the top bank apart. Learn about significant trends and expert advice to make informed decisions for your business financial needs.

Easiest Credit Cards for Instant Approval in 2025

Finding credit cards that offer instant approval can be a game changer for individuals seeking to quickly access credit or improve their financial standing. This guide explores the types of cards that provide instant decisions, considerations before applying, and tips to enhance approval chances. It also covers best practices for maintaining these cards to ensure long-term financial health. Understanding these can help set the foundation for a successful credit journey.

How to Earn a Rs. 10,000 Monthly Interest with SBI's Gold Loan Options

Many individuals consider leveraging their gold assets to secure a stable monthly income through bank schemes in India. By choosing a gold loan with SBI, it is possible to receive a monthly interest of Rs. 10,000 or more. This article explores how SBI's gold loan works, the various benefits it offers, and important considerations for potential borrowers. It also delves into necessary qualifications you need to meet and clever tips to optimize your earnings.

Easiest Banks for Securing a Home Loan

Many aspiring homeowners wonder which banks offer the most straightforward approval process for home loans. This article delves into the lending practices of various banks, highlighting those with more lenient approval criteria and quicker disbursal times. It examines factors influencing loan approval and provides tips for increasing the chances of securing a home loan smoothly. The article serves as a guide for prospective borrowers, helping them understand how to navigate the home loan landscape effectively.

Easiest Unsecured Credit Cards to Obtain: Your Path to Instant Approval

Navigating the world of unsecured credit cards can be tricky, but several options make it easier for individuals to get approved, even with a limited credit history. Understanding the criteria lenders use and knowing which cards offer more lenient approval requirements helps you select the right card for your needs. This guide will explore some of the most accessible unsecured credit cards, outline the factors that influence approval, and provide tips on how to strengthen your application.

Investing in SIPs: What Happens When You Invest $5,000 for 5 Years?

Imagine setting aside $5,000 and investing it through a Systematic Investment Plan (SIP) in India's mutual funds for five years. This approach not only simplifies investing but also capitalizes on the power of compounding. During these years, consistent investing can weather market volatility and potentially increase savings significantly. With insights into how SIPs work and their benefits, investors can better plan their financial future.

Top Savings Accounts for a 10% Return on Investment in 2024

Exploring opportunities for a 10% return on investment in today's fluctuating financial landscape is the dream for many. Although the journey to find such returns is fraught with challenges, certain strategies and accounts offer promising avenues. This article delves into effective savings options and investment tactics that can potentially yield high returns. Understanding the market and staying informed on current trends is crucial. Readers will gain insight into the best savings accounts available in 2024 to maximize their earnings.

About Us

Secure Digital Banking India provides comprehensive insights into the evolving digital finance landscape in India, guiding both consumers and professionals towards secure and efficient banking. With a focus on innovation and security, we offer valuable resources and updates on financial trends and regulations. Our mission is to empower users with the knowledge necessary for safe online banking. Explore our platform to enhance your digital finance expertise.

Terms of Service

These Terms of Service outline the rules and regulations for the use of Secure Digital Banking India's website, detailing user responsibilities, intellectual property rights, disclaimers, and contact information. It serves as a legally binding agreement between the user and the website owner.