GST Qualification Checker

Enter details and click "Check GST Qualification" to see if your supply attracts GST.

When you hear GST is a comprehensive indirect tax levied on the supply of goods and services across India, the first question that pops up is: what exactly qualifies for this tax? The answer isn’t a simple yes or no - it depends on the type of supply, the place of supply, and the status of the buyer or seller. This guide walks you through every scenario that triggers GST, helps you spot the gray areas, and gives you a ready‑to‑use checklist so you stop guessing and start complying.

Key Takeaways

- Only "supply" of goods or services that is taxable, nil‑rated, or exempt falls under GST; merely owning a product does not.

- Four main categories decide applicability: taxable supply, exempt supply, nil‑rated supply, and out‑of‑scope supply.

- Registration becomes mandatory when your aggregate turnover exceeds ₹40lakhs (₹20lakhs for special category states).

- Different GST rates (0%, 5%, 12%, 18%, 28%) apply based on the HSN code and the nature of the product or service.

- Reverse charge and composition scheme are special mechanisms that alter who pays the tax.

Understanding "Supply" - The Core of GST Qualification

In GST law, the word taxable supply is any supply of goods or services on which GST is chargeable, whether at standard, reduced, or nil rate. Supply covers a wide range of transactions - sale, transfer, barter, exchange, lease, licensing, and even services rendered for free (if they meet certain criteria). So, if you sell a laptop, provide consulting, or rent out a warehouse, each act is a supply that may attract GST.

Four Pillars That Determine GST Applicability

Not every supply ends up with a tax bill. The law splits supplies into four buckets:

| Category | Definition | Tax Effect |

|---|---|---|

| Taxable supply (goods or services on which GST is payable) | Includes most commercial transactions. | GST levied at applicable rate. |

| Exempt supply (specific goods/services fully exempt from GST) | Education, healthcare, agricultural produce (unprocessed). | No GST, but input tax credit cannot be claimed. |

| Nil‑rated supply (goods or services taxed at 0%) | Fresh fruits, bread, certain exports. | GST at 0%; input tax credit can be claimed. |

| Out‑of‑scope supply (transactions not covered by GST law) | Sale of land, shares, certain government taxes. | No GST, but also no input tax credit. |

Understanding which bucket your transaction falls into is the first step toward proper compliance.

When Does a Business Need to Register for GST?

Even if a supply is taxable, you might escape GST only if you’re below the turnover threshold. GST registration is mandatory for every person whose aggregate turnover exceeds ₹40lakhs nationwide (₹20lakhs for Northeastern and hill states). The threshold includes all taxable supplies, nil‑rated supplies, and exempt supplies aggregated over a financial year.

Key points to remember:

- Registration is compulsory if you cross the limit at any time during the year.

- Voluntary registration is allowed for businesses wanting to claim input tax credit.

- Special category taxpayers (e‑commerce operators, non‑resident taxable persons) have separate criteria.

Decoding GST Rates - From 0% to 28%

Once you know a supply is taxable, the next puzzle is the rate. The GST rates are determined by the HSN (Harmonized System of Nomenclature) code assigned to each product or service. The government classifies items into five brackets:

- 0% - Essential items like fresh fruits, bread, and unprocessed cereals.

- 5% - Items of mass consumption such as edible oil, tea, and mobile phones (basic models).

- 12% - Certain pharmaceuticals, computers, and processed foods.

- 18% - Most services, garments, and electronics.

- 28% - Luxury goods like high‑end cars, aerated drinks, and cigarettes.

To find the exact rate, look up the HSN code on the GST portal or refer to the official rate schedule released each year.

Special Mechanisms: Reverse Charge and Composition Scheme

Two scenarios flip the usual responsibility of paying GST:

Reverse charge mechanism (the liability to pay GST shifts from the seller to the buyer) applies when the seller is unregistered or when a specific supply (e.g., legal services, certain contracts) demands it. In such cases, the buyer must self‑assess and deposit the tax.

The Composition scheme (a simplified tax option for small taxpayers opting to pay GST at a flat rate on turnover) lets businesses with turnover up to ₹1.5crore (₹75lakhs for services) pay a 1% or 2% GST instead of the regular rates. Benefits include no need to file detailed returns, but they cannot claim input tax credit.

Checklist: Does Your Transaction Qualify for GST?

Use this quick list to decide if GST applies:

- Is there a supply of goods or services?

- Do the goods/services belong to a taxable or nil‑rated category?

- Is the buyer a registered taxpayer? If not, could reverse charge apply?

- Does your annual turnover exceed the registration threshold?

- Do you fall under the composition scheme, and have you opted for it?

If you answered “yes” to the first two items, GST qualification is likely, and you should ensure proper invoicing, HSN coding, and tax payment.

Common Pitfalls and How to Avoid Them

Even seasoned entrepreneurs stumble over these traps:

- Confusing exempt with nil‑rated: Both appear tax‑free, but only nil‑rated supplies allow you to claim input tax credit.

- Missing registration deadline: Once you cross the turnover limit, you have 30 days to register or face penalties.

- Incorrect HSN code: A wrong code can lead to a higher rate or a compliance notice.

- Overlooking reverse charge: Forgetting to self‑assess can result in interest and late fees.

- Assuming composition waives all filing: You still need quarterly returns, albeit simplified.

Double‑check every invoice against the above points, and you’ll keep the tax man happy.

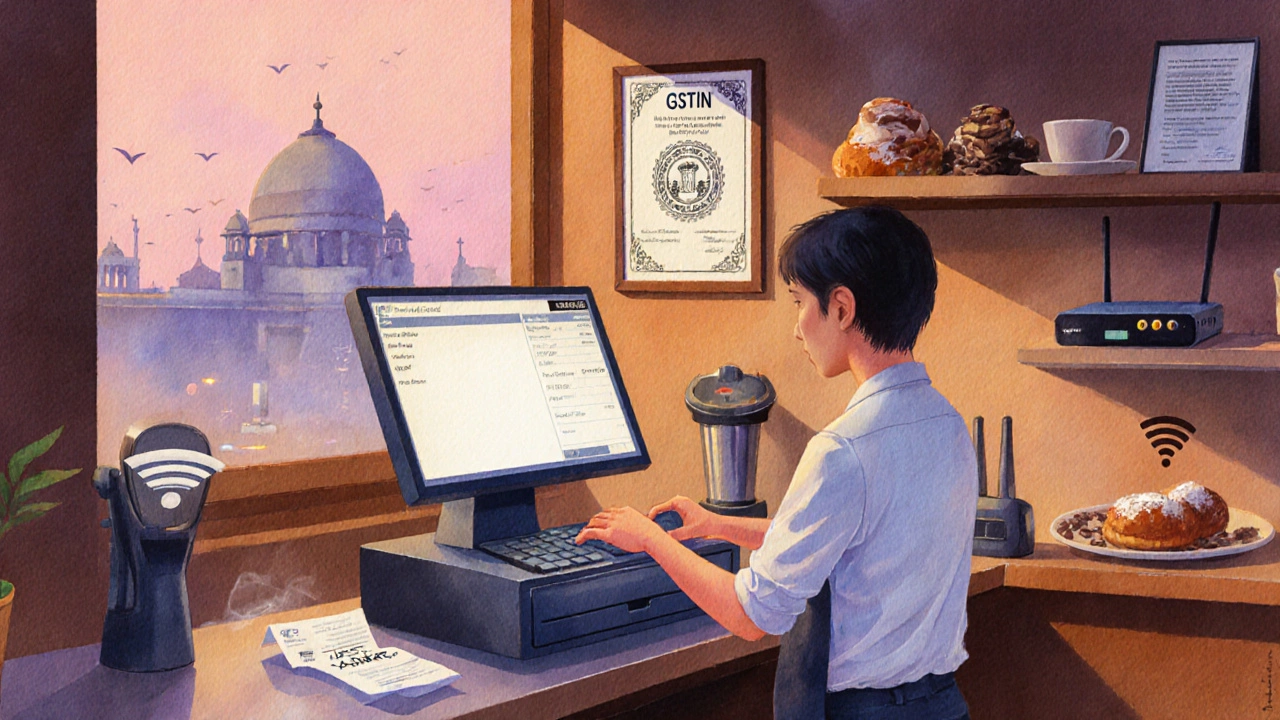

Practical Example: A Small Café

Imagine a café in Mumbai with an annual turnover of ₹45lakhs. It sells coffee, pastries, and provides Wi‑Fi. Here’s how GST qualification plays out:

- Supply? Yes - food items and services.

- Category? Coffee (taxable at 18%), pastries (18% or 5% if deemed essential), Wi‑Fi (taxable at 18%).

- Registration? Turnover > ₹40lakhs, so mandatory GST registration.

- Rates? Use HSN codes 1905 (coffee) and 1905 for pastries, both 18%.

- Input credit? The café can claim credit on electricity, kitchen equipment, and rent invoices.

By following the qualification steps, the café avoids surprise tax bills and can even reduce costs through input credit.

Next Steps for Businesses

Once you’ve confirmed GST applicability, act on these items:

- Register on the GST portal: Obtain a GSTIN within 30 days of crossing the threshold.

- Classify every product/service: Assign correct HSN codes and rates.

- Issue compliant invoices: Include GSTIN, HSN, rate, and amount.

- Maintain records: Keep purchase and sale registers for at least 6 years.

- File returns timely: GSTR‑1 (outward), GSTR‑3B (summary), and GSTR‑9 (annual) as per schedule.

Following this roadmap turns GST from a headache into a predictable compliance routine.

Frequently Asked Questions

What is the difference between exempt and nil‑rated supplies?

Exempt supplies are wholly free from GST, and you cannot claim input tax credit on purchases related to them. Nil‑rated supplies are also taxed at 0%, but you are allowed to claim input credit for inputs used to make those supplies.

When does the reverse charge mechanism apply?

Reverse charge kicks in when the seller is unregistered or when the law specifically lists a supply (e.g., legal services, certain construction contracts) as reverse charge. In such cases, the buyer self‑assesses and pays the GST.

Can a small service provider opt for the composition scheme?

Yes, if the annual turnover is up to ₹75lakhs for services. The provider pays a flat 6% GST on turnover and cannot claim input tax credit, but filing is simplified.

How do I find the correct HSN code for my product?

Visit the GST portal’s HSN lookup tool, or consult the latest rate schedule released by the CBIC. Matching the product description to the 8‑digit code ensures you apply the right rate.

What penalties do I face for late GST registration?

A late fee of ₹100 per day up to a maximum of ₹5,000, plus interest on any tax due, can be imposed. Repeated delays may attract higher penalties and prosecution.