When you hear the word “unicorn” in the Indian startup world, the name that pops up first is Flipkart - a home‑grown e‑commerce platform that broke the $1 billion valuation barrier back in 2012. That moment didn’t just put Flipkart on the global map; it sparked a fever‑ish rush of venture capital into India and gave birth to a whole new generation of billion‑dollar dreams.

Key Takeaways

- Flipkart became India’s first unicorn in August 2012 after a $1 billion valuation by SoftBank.

- The funding round was led by SoftBank with participation from Tiger Global Management and Sequoia Capital.

- Flipkart’s success accelerated the rise of the Indian startup ecosystem, paving the way for later unicorns like Paytm, OYO, and Byju’s.

- Understanding the early unicorn’s journey helps founders spot the funding patterns that still dominate today.

What Exactly Is a Unicorn?

A “unicorn” is a privately held startup valued at $1 billion or more. The term was coined by venture capitalist Aileen Lee in 2013 to highlight how rare such companies were - like the mythical beast. In India, the label took on extra weight because it signaled that the country could produce globally competitive tech companies without relying on foreign headquarters.

The Road to $1 Billion: Flipkart’s Funding Timeline

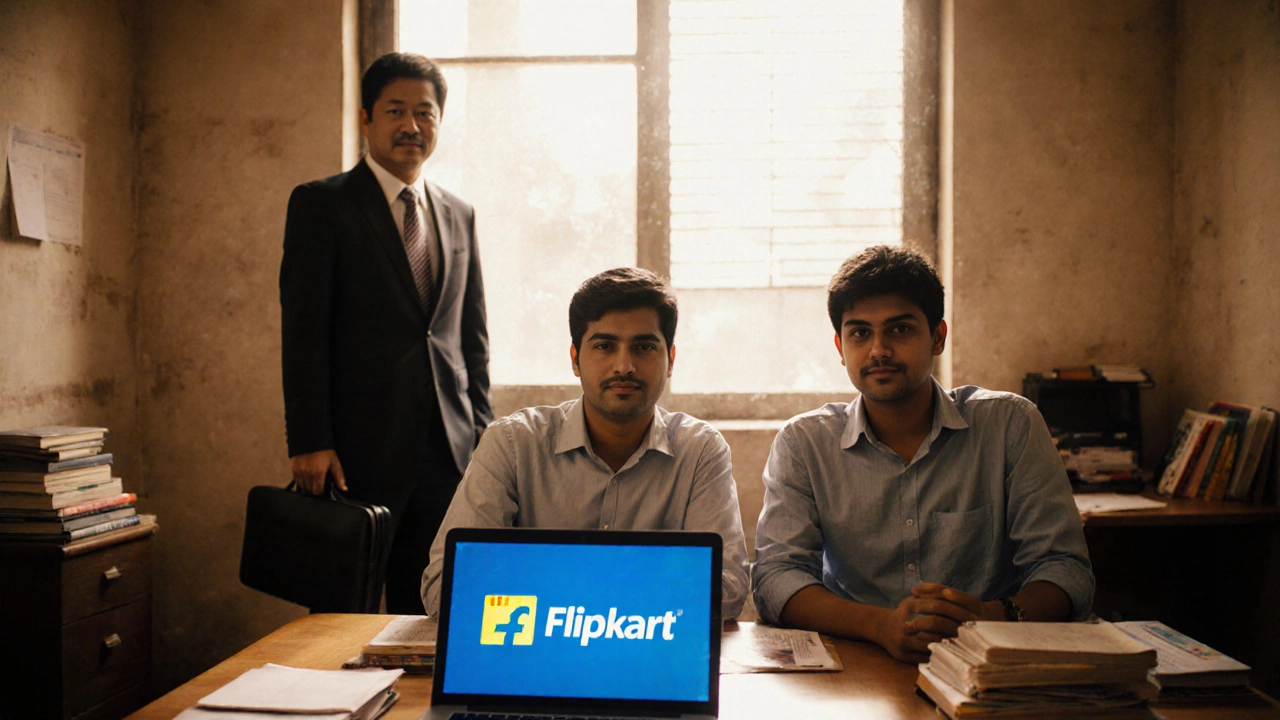

Flipkart started in 2007 as an online bookstore founded by Sachin Bansal and Binny Bansal. Early seed money came from friends and family, followed by a Series A from Accel Partners in 2009. The pivotal moment arrived in August 2012 when SoftBank injected $1 billion, crowding in Tiger Global Management and Sequoia Capital. The post‑money valuation crossed the $1 billion threshold, officially making Flipkart India’s first unicorn.

Why Flipkart’s Unicorn Status Mattered

Before Flipkart, Indian startups could raise millions, but nobody had broken the billion‑dollar wall. The unicorn label sent a clear signal to global investors: India was a massive, untapped market with home‑grown tech talent. In the months that followed, foreign firms poured capital into Indian companies, and the phrase “India unicorn” became a buzzword at every pitch meeting.

Early Unicorns That Followed

Flipkart’s success opened the floodgates. Within two years, Paytm (2015), OYO Rooms (2015), and Byju’s (2016) all crossed the $1 billion mark. Each had a different business model - fintech, hospitality, ed‑tech - showing that the unicorn phenomenon wasn’t limited to e‑commerce. The table below highlights the first wave of Indian unicorns and the key metrics that defined them.

| Startup | Year Reached Unicorn | Valuation at Unicorn | Lead Investor | Sector |

|---|---|---|---|---|

| Flipkart | 2012 | $1.1 B | SoftBank | E‑commerce |

| Paytm | 2015 | $1.5 B | Alibaba Group | Fintech |

| OYO Rooms | 2015 | $1.0 B | SoftBank | Hospitality |

| Byju’s | 2016 | $1.5 B | General Atlantic | Ed‑tech |

Lessons From Flipkart’s Unicorn Journey

For founders eyeing the unicorn milestone, a few patterns stand out from Flipkart’s story:

- Big‑ticket investors matter: SoftBank’s deep pockets not only capitalized the round but also added credibility.

- Scale fast, think national: Flipkart expanded from books to electronics, fashion, and groceries, covering Tier‑I and Tier‑II cities within a few years.

- Logistics is a moat: Building an in‑house supply‑chain helped keep costs low and delivery times short - something rivals struggled with.

- Exit strategy worked: The 2018 acquisition by Amazon gave investors a multi‑billion‑dollar return and cemented the unicorn’s legacy.

Impact on Today’s Funding Landscape

Fast‑forward to 2025, and India now boasts over 150 unicorns across sectors. The capital available has jumped from a few hundred million in 2012 to more than $30 billion in active VC funds. Yet the DNA of Flipkart’s rise - aggressive scaling, strategic investor partnerships, and a focus on solving Indian consumer problems - still guides most pitch decks today.

How to Spot the Next Unicorn

If you’re a budding entrepreneur, keep an eye on three signals that echo Flipkart’s early days:

- Market size: Is the addressable market larger than ₹10,000 crore?

- Capital readiness: Do you have a clear path to a Funding Round that can push valuation past $1 billion?

- Defensible advantage: Are you building something (logistics, data, network effects) that competitors can’t copy overnight?

Answering “yes” to at least two of these questions puts you on the unicorn radar.

Frequently Asked Questions

When did Flipkart become India’s first unicorn?

Flipkart crossed the $1 billion valuation in August 2012 after a $1 billion investment led by SoftBank.

Which investors were part of the historic 2012 funding round?

The round was led by SoftBank and included Tiger Global Management and Sequoia Capital.

Why is the unicorn label so important for Indian startups?

It signals to global investors that the company has achieved a scale and valuation comparable to world‑class tech firms, unlocking larger funding pools.

What sectors followed e‑commerce in producing early unicorns?

Fintech (Paytm), hospitality (OYO Rooms), and ed‑tech (Byju’s) were the next big winners, each hitting $1 billion valuations between 2015‑2016.

How can a startup increase its chances of becoming a unicorn?

Focus on a massive addressable market, build strong network effects or logistical moats, and attract strategic investors who can provide both capital and credibility.

Next Steps for Aspiring Founders

Ready to chase the unicorn dream? Start by mapping your market size, drafting a clear funding roadmap, and reaching out to investors who have a track record of backing Indian high‑growth companies. Keep an eye on emerging sectors like AI‑driven healthtech and climate‑tech - those are the next frontiers where the next unicorns may sprout.

Flipkart showed that a home‑grown idea, backed by the right capital, can rewrite the rules. The same ingredients are still at play today; it’s just a matter of mixing them in the right proportion.